Market Recap:

Read today's ongoing market commentary for the recap..

I'd like to point out my prediction this morning where I said. "Today I expect a bounce off the area near 1055." I said it would be in the afternoon. I even gave a limit, the bounce occurred at 1058.24. I don't believe you are finding this type of accuracy anywhere else

I'll tell you once again that I'm disappointed in the readers of this blog who return here every day There are about fifty of you.

Soon you may discover that you no longer have access to this blog, and it will be because you have been selfish with your comments. I'm not begging for praise, just some sign of life on the other side.

I'm making a list of people who will have access. To assure access to this blog when it goes private please e-mail me at KumoBob@sbcglobal.net. If I don't have your email I will not be able to add you to the list, and this blog will deny all access and contact with me. At that point it becomes a dead end.

Clearly I'm not into readership numbers. What I'm looking for are intelligent people who share an interest in Technical Analysis and wish to converse on any level about that. I've heard from several of you that this blog is overwhelming, intimidating, and confusing. Why then don't you ask? I've always replied with a full explanation when asked about anything pertaining to the TA on this blog. There is no excuse for your silence. It's an insult and I am angry.

14:30

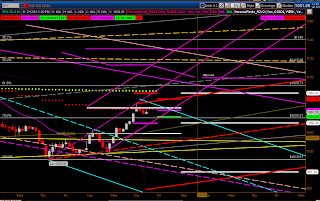

Considering that we are at the top Weekly Persons Pivot I give the Bearish scenario a higher chance. Looking at the Daily candles we are now in a position to create either a Bearish Evening Star or a Dark Cloud Cover pattern. It's possibly a little premature to be anticipating, but if the day finishes Black and if Friday is a Long Black Candle; a Bearish Evening Star or a Dark Cloud Cover will be formed. This is what Bears dream about.

The daily indicators are currently Bullish, but the hourly has changed to Bearish. Price is currently toying with the top of the 0.80 % Standard Deviation so this area may return to the line of Linear Regression . Basically I believe the scales are tipped slightly in favor of the Bears.

Not shown in the chart above is the strong support of the Hourly Kumo at 1055. This Kumo weakens and turns down on Monday. There is a good chance Price will slide down the top edge of this Kumo.

12:15 ET

Today I expect a bounce off the area near 1055. The Magenta fork appears to be quite viable and the top sector may be explored. Yes the Cyan Fork may fail, possibly late in the day. Breaking the bottom of the Magenta fork would lead to a bearish scenario. at this point the two forks are in conflict. At no point today, would I expect Price to exceed 1084. Currently Price is at 1062. This is a major battle between the Bulls and Bears.

Should the Bears win this battle the red fork shown below will begin to influence Price. This scenario fits nicely within the cyan fork giving this scenario an edge.

Sorry for the wavering analysis but clearly the market has just come out of a period of indecision and the knee jerk response seen yesterday is probably not convincing to a major portion of the players. If doubt wins out over optimism the Bears will take over, but this trading range may linger until a decisive move below 1000 is obtained.

.

11:00 ET

The cyan fork should hold today. I've included the coordinators in the screen capture so that you can set this fork up on your screen.

Analysis presented on this Blog has only informational, and educational purpose, and does not represent a proposal for buying or selling contracts, equities or currency.

No comments:

Post a Comment